Baru-baru ini, situasi tegang konflik Israel-Palestin telah memungkinkan perang meningkat, yang sedikit sebanyak menjejaskan turun naik harga minyak antarabangsa, mengekalkannya pada tahap yang tinggi. Dalam konteks ini, pasaran kimia domestik juga telah dilanda oleh kedua-dua harga tenaga huluan yang tinggi dan permintaan hiliran yang lemah, dan prestasi pasaran keseluruhan kekal lemah. Walau bagaimanapun, data makro dari September menunjukkan bahawa keadaan pasaran bertambah baik sedikit, yang menyimpang daripada prestasi lembap pasaran kimia baru-baru ini. Di bawah pengaruh ketegangan geopolitik, minyak mentah antarabangsa terus turun naik dengan kuat, dan dari perspektif kos, terdapat sokongan di bahagian bawah pasaran kimia; Walau bagaimanapun, dari perspektif asas, permintaan untuk emas, perak, dan komoditi lain masih belum meletus, dan adalah fakta yang tidak dapat dinafikan bahawa mereka akan terus melemah. Oleh itu, pasaran kimia dijangka meneruskan aliran menurun dalam masa terdekat.

Pasaran kimia kekal lembap

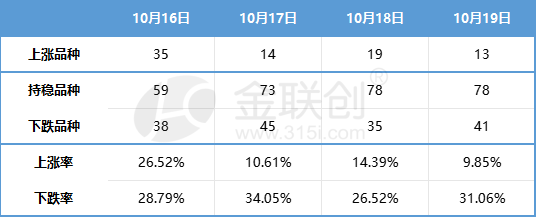

Minggu lepas, harga spot kimia domestik terus menunjukkan prestasi lemah. Menurut 132 produk kimia yang dipantau oleh Jinlianchuang, harga spot domestik adalah seperti berikut:

Sumber data: Jin Lianchuang

Peningkatan kecil data makro pada bulan September menyimpang daripada kemerosotan baru-baru ini dalam industri kimia

Biro Perangkaan Kebangsaan mengeluarkan data ekonomi untuk suku ketiga dan September. Data menunjukkan bahawa pasaran runcit barangan pengguna terus pulih, aktiviti pengeluaran perindustrian kekal stabil, dan data berkaitan hartanah juga menunjukkan tanda-tanda peningkatan kecil. Walau bagaimanapun, walaupun terdapat beberapa penambahbaikan, tahap penambahbaikan masih terhad, terutamanya penurunan ketara dalam pelaburan hartanah, yang menjadikan hartanah masih mengheret ekonomi domestik.

Daripada data suku ketiga, KDNK meningkat sebanyak 4.9% tahun ke tahun, lebih baik daripada jangkaan pasaran. Pertumbuhan ini didorong terutamanya oleh peningkatan ketara dalam daya penggerak penggunaan. Bagaimanapun, kadar pertumbuhan kompaun empat tahun (4.7%) pada suku ketiga masih lebih rendah daripada 4.9% pada suku pertama. Di samping itu, walaupun deflator KDNK meningkat sedikit daripada -1.5% pada suku kedua kepada -1.4% tahun ke tahun, ia kekal negatif. Semua data ini menunjukkan bahawa ekonomi masih memerlukan pembaikan selanjutnya.

Pemulihan ekonomi pada bulan September didorong terutamanya oleh permintaan dan penggunaan luar, tetapi pelaburan masih terjejas secara negatif oleh hartanah. Pengeluaran akhir September telah pulih berbanding Ogos, dengan nilai tambah industri dan indeks pengeluaran industri perkhidmatan meningkat masing-masing sebanyak 4.5% dan 6.9% tahun ke tahun, yang pada asasnya sama seperti Ogos. Bagaimanapun, kadar pertumbuhan kompaun empat tahun masing-masing meningkat sebanyak 0.3 dan 0.4 mata peratusan berbanding Ogos. Daripada perubahan dalam permintaan pada bulan September, pemulihan ekonomi didorong terutamanya oleh permintaan dan penggunaan luar. Kadar pertumbuhan kompaun empat tahun sifar sosial dan eksport telah bertambah baik berbanding Ogos. Walau bagaimanapun, penurunan kadar pertumbuhan kompaun pelaburan aset tetap masih dipengaruhi terutamanya oleh kesan negatif hartanah.

Dari perspektif bidang hiliran utama kejuruteraan kimia:

Dalam sektor hartanah, penurunan tahun ke tahun dalam jualan rumah baharu pada bulan September hanya bertambah baik sedikit. Untuk menggalakkan pembangunan dasar dari segi penawaran dan permintaan, usaha selanjutnya diperlukan. Walaupun pelaburan hartanah masih lemah, pembinaan baharu menunjukkan trend peningkatan secara berperingkat, sementara penyiapan terus mengekalkan kemakmuran.

Dalam industri automotif, runcit “Jinjiu” meneruskan aliran pertumbuhan positif pada asas bulan ke bulan. Disebabkan peningkatan permintaan untuk perjalanan percutian dan aktiviti promosi pada akhir suku tahun, walaupun jualan runcit mencapai paras tertinggi dalam sejarah pada bulan Ogos, jualan runcit kereta penumpang pada bulan September meneruskan trend pertumbuhan positif pada asas bulan ke bulan, mencecah 2.018 juta unit. Ini menunjukkan bahawa permintaan terminal masih stabil dan bertambah baik.

Dalam bidang perkakas rumah, permintaan domestik kekal stabil. Menurut data dari Biro Perangkaan, jumlah jualan runcit barangan pengguna pada bulan September ialah 3982.6 bilion yuan, peningkatan sebanyak 5.5% tahun ke tahun. Antaranya, jumlah jualan runcit perkakas rumah dan peralatan audiovisual ialah 67.3 bilion yuan, penurunan tahun ke tahun sebanyak 2.3%. Walau bagaimanapun, jumlah jualan runcit barangan pengguna dari Januari hingga September ialah 34210.7 bilion yuan, peningkatan tahun ke tahun sebanyak 6.8%. Antaranya, jumlah jualan runcit perkakas rumah dan peralatan audiovisual ialah 634.5 bilion yuan, penurunan tahun ke tahun sebanyak 0.6%.

Perlu diingat bahawa peningkatan kecil dalam data makro bulan September menyimpang daripada trend lembap baru-baru ini dalam industri kimia. Walaupun data bertambah baik, keyakinan industri terhadap permintaan bagi suku keempat masih secara relatifnya tidak mencukupi, dan jurang dasar pada bulan Oktober juga menjadikan industri mempunyai sikap terpelihara terhadap sokongan dasar untuk suku keempat.

Terdapat sokongan di bahagian bawah, dan pasaran kimia terus berundur di bawah permintaan yang lemah

Konflik Palestin-Israel telah mencetuskan lima peperangan berskala kecil di Timur Tengah, dan dijangka sukar untuk mencari penyelesaian dalam jangka pendek. Dengan latar belakang ini, peningkatan keadaan di Timur Tengah telah membawa kepada turun naik yang kukuh dalam pasaran minyak mentah antarabangsa. Dari perspektif kos, pasaran kimia telah mendapat beberapa sokongan terendah. Walau bagaimanapun, dari perspektif asas, walaupun pada masa ini adalah musim puncak tradisional untuk permintaan emas, perak dan sepuluh, permintaan tidak meletup seperti yang dijangkakan, tetapi terus lemah, yang merupakan fakta yang tidak dapat dinafikan. Oleh itu, pasaran kimia dijangka meneruskan aliran menurun dalam masa terdekat. Walau bagaimanapun, prestasi pasaran produk tertentu mungkin berbeza-beza, terutamanya produk yang berkait rapat dengan minyak mentah mungkin terus mempunyai arah aliran yang lebih kukuh.

Masa siaran: 23-Okt-2023